Child Support and Shared Care

One of the major barriers to achieving presumptive shared care is a fair and reasonable child support system to support the presumption.

There is no doubt that the current Child Support Act 1991 was designed at a time when shared parenting was a “rarity” and the assumption was one custodial parent and one liable parent was the norm.

Talking to a number of people it is obvious that very few people actually understand how the variation of the child support (TAX) for shared care actually works.

So how does the Act cater for shared care?

– By adjusting the living allowance, the percentage applied or both.

– Here is a summary and some examples.

Remember the formula is (a-b) x c = Child Support (TAX) payable

Where:

a=gross (before tax) income

b=living allowance

c = the child support (TAX) percentage

Where parents share care (40% of the nights, 146 night a year) shared care exists. Under this situation both parents can claim child tax as both parents are effectively custodial parents.

Many parents have disputes over this and IRD ignore court orders as having little relevance.

A parent may have a Family Court ordered parenting agreement that states care is shared 50/50 and IRD will not act on that alone as they maintain they want to “know what the real situation”.

It is also possible to have less than 40% of the nights but have “substantially equal shared care”. The same formula application would apply.

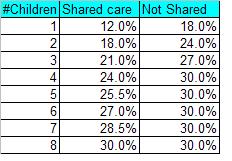

How much does the Percentage Change?

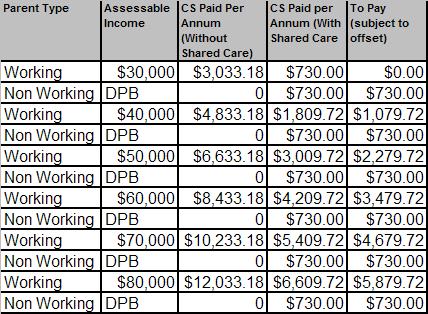

Let’s look at a family where one parent is in receipt of the DPB and the other with an assessable income in a range from 30-80K and has shared care of a single child and has not re-partnered.

Note: Figures are generated using IRD 150 and are for the tax year 1 April 2006 to 31 March 2007. Living allowance is $24,919.

So what’s that produce? Many would argue a blatantly unfair result.

Remember the entire Child support collected will go to “recovering the DPB” and no money will pass directly to either parent for care of the child.

The DPB recipient will stand to loose $730 for sharing care with the other parent.

Note, if the other parent is not receiving a benefit they can choose not to collect any money from the DPB recipient. This of course increases their payment by $730 per annum as no offset occurs.

Note how the more the working parent earns the greater the contribution required.

The formula serves well to recover a benifit but actually discourages shared care, the best outcome for children, by :

-Costing the DPB a significant ammount of their income

-Attempting to equalise income between households (effectively spousal maintenance)

Have a look at the figures above and for a 50/50 share of care and answer this question : How on earth is the result fair or reasonable.

I will publish more examples of how shared care works and the anomalies if requested.

Regards

Scrap

N.B. Comments on this thread will be moderated and any off topic will be deleted.

Copyright James Nicolle 2007